Sonata Software has announced its unaudited financial results for the quarter and half-year ended September 30, 2025. The company declared its second interim dividend at ₹1.25 per share, reaffirming its commitment to a quarterly dividend payout for the current financial year. This update comes as Sonata Software continues to scale its global footprint in cloud, data, automation, and modernization services, with strong client momentum across key markets.

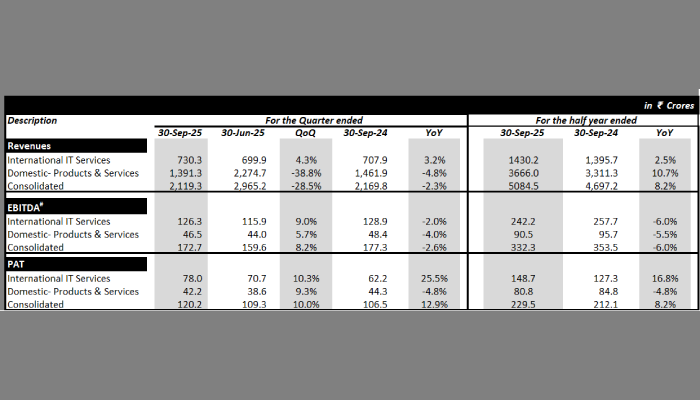

For Q2 FY26, Sonata Software’s consolidated profit after tax (PAT) grew by 10% quarter-on-quarter, reaching ₹120.2 crore. Despite a 28.5% QoQ decline in consolidated revenue to ₹2,119.3 crore, the company delivered higher EBITDA margins of 8.1%, up by 280 basis points over the previous quarter. Management attributed these gains to strategic execution, disciplined investments in Artificial Intelligence, cloud modernization, and robust order book traction in verticals like healthcare. AI-driven orders now represent almost 10% of the overall order book, reflecting accelerating client interest in AI-powered digital transformation and modernization.

Mr. Sujit Mohanty, MD & CEO of Sonata Information Technology Limited, added, “We continue to execute on our three-pillar strategy focused on driving growth in the Microsoft SMC sector, expanding our AI-led partnerships with ISVs, and securing large system integration deals. During the quarter, we added new clients across all three pillars, with particularly strong traction in the Microsoft SMC segment. Despite prevailing industry headwinds in certain sectors, our disciplined execution and focused investments continue to position us well for sustained growth.”

International IT services revenue in US dollar terms stood at $82.0 million, growing 0.2% QoQ and 1% in constant currency. In rupee terms, international IT services revenue rose 4.3% QoQ to ₹730.3 crore, with EBITDA margins improving by 70 basis points. The segment added six new clients this quarter and secured significant deals in the healthcare sector, supporting Sonata’s ongoing push towards large-value digital transformation opportunities. Days sales outstanding (DSO) was reported at 68 days, while return on capital employed (ROCE) and return on net worth (RONW) improved to 17.8% and 22.6% respectively.

The domestic products and services division witnessed revenue of ₹1,391.3 crore, down 38.8% sequentially, but achieved stable gross contribution and EBITDA margin improvement. PAT for the division increased to ₹42.2 crore, a 9.3% QoQ rise, driven by improved operational efficiency and strategic focus on high-margin sectors. DSO and ROCE improved to 42 days and 43.8%, respectively, further boosting overall company performance.

Sonata Software, with over $1 billion in annual revenue, stands out as a premier AI modernization engineering company. Its proprietary Platformation.AI methodology and the Harmoni.AI suite power rapid digital transformation for Fortune 500 clients across banking, financial services and insurance (BFSI), healthcare, telecommunications, technology, retail, manufacturing, and distribution industries.

The company has launched the innovative AgentBridge platform to help enterprises drive intelligent, scalable AI-driven operations, underpinned by industry-best partnerships with Microsoft and AWS. Sonata is recognized as a key Microsoft AI Partner Council member and an AWS Generative AI Competency achiever, further strengthening its expansion in cloud, data, cyber security, and AI-led business solutions.